President’s Letter

Last year was a dramatic year for the national preservation community. After months of advocacy, the 20 percent federal historic tax credit (FHTC) survived a significant rewrite of the tax code. Preservation Iowa partnered with Main Street Iowa, Smart Growth, and the National Trust to successfully convince Iowa’s congressional delegation that incentivizing the rehabilitation of our historic buildings makes good economic sense. Preservation Iowa would like to thank Representative Blum and Senator Grassley for advocating the efficacy of the tax program to their Republican colleagues.

For those who missed the excitement, The Tax Cut and Jobs Act, also known as House Resolution #1, introduced on November 2, 2017, proposed repealing both the 20 and 10 percent rehabilitation tax credits. The proposed Senate tax reform bill reduced the 20 percent FHTC by half and eliminating the 10 percent older building credit entirely.

An amendment to restore the FHTC to 20 percent was offered by Sen. Cassidy and was cosponsored by Iowa’s Senator Grassley. This amendment was accepted; however, the authors of the amendment needed to identify a way to offset the cost of the incentive. The solution was to take the FHTC in phases over five years instead of in its entirety the year a rehabilitated building is completed. The Joint Committee on Taxation estimated that phasing the FHTC in this way reduces the cost of the program by approximately $2 billion over 10 years.

We expect that 2018 will be a dramatic year for Iowa’s preservation community. The state of Iowa currently has a 25 percent historic tax credit (SHTC). Our tax credit is unique because, unlike the Federal Tax Credit, it is available to residential properties and non-profit organizations. Last year a few bills bounced around that would have capped or eliminated the SHTC. Those bills did not become law, but they may return in the 2018 legislative session.

We also expect that the State Historical Society of Iowa (SHSI) will not be adequately funded. With a dual mission of preservation and education, the SHSI maintains a museum, archives & historical libraries, preservation office, and eight historic sites. These bureaus preserve and provide access to Iowa’s historical resources through a variety of statewide programs, exhibitions and projects while serving as an advocate for Iowa’s past and connector to the future. Their state support has waned over the past few years while costs, needs, and expectations climb. In short, less money for history simply means less Iowa History.

Finally, REAP (Resource Enhancement and Protection) continues to be underfunded. Five percent of this program is allocated for historic resources, also known as HRDP grants. For many communities, HRDP grants are a lifeline to protect historic resources, enhance museums, and interpret history.

As our state legislators consider ways to balance a precarious budge, it is critical that we all continue to advocate for historic preservation. I recommend that everyone talk with their elected officials representing them in Des Moines–regardless of party affiliation–and point to a historic resource in your community that has anchored your community, improved your neighborhoods, or contributed to the economic success of your town.

Joshua James Moe, President

Preservation Iowa

PRESERVATION IOWA SUPPORTS ISU; LEARNS FROM MICHIGAN

Preservation Iowa welcomed Nancy Finegood, executive director of the nonprofit Michigan Historic Preservation Network, to Ames for “Vacant Not Blighted,” a free public lecture. Finegood shared examples of surveys, technology, and innovative programs as important tools in addressing “blighted” communities. Her talk promoted the idea that preservation and rehabilitation

Preservation Iowa Board at the State Capitol Law Library

are much more effective than demolition to address “blight” in legacy cities (older industrial cities that have experienced sustained job and population loss over the past several decades).

The lecture was held on Iowa State’s campus, but was open to the public. The lecture was well-attended and affirms the growing relationship between Iowa State University and Preservation Iowa.

Ms. Finegood remained in Iowa and attended the Preservation Iowa annual meeting. She shared strategies used by the Michigan Historic Preservation Network for growing capacity and effectively advocating for preservation. During a lunch break, the PI board took a short field trip to the State Capitol.

PRESERVATION IOWA AWARDS TWO COUNTRY SCHOOL MINI GRANTS

The Alton and Fairview schools have been awarded mini grants to help with preservation projects. Funding was made available with money collected at 18th annual country school conference held in Sheldon last October.

The Alton school is part of the Forest Park Museum complex located near Perry on the Madison/Dallas County border. The funding will be used to help complete work on an innovative, interactive audio-visual exhibit that will allow visitors to view historic photos and maps to learn about country schooling in Iowa and the Alton school.

Representatives from the Alton school will demonstrate this program at the upcoming Preservation Iowa Country School in Winterset on Friday Sept. 28. On Saturday, the Alton school will be included on a tour of area preserved schools and bridges in Madison County.

The Fairview School project includes more traditional upkeep and repairs. Fairview was recently moved into a historical complex being organized by the Moravia Historical Society. Moravia is located on the Appanose/Monroe county line three blocks from an elementary school. Development of the school will enhance the historical village and help children and adults understand the role country schools played in Iowa’s history.

For the past three years Preservation Iowa has been able to award mini grants with funding raised at the annual country school preservation conference.

FINAL TAX BILL RETAINS A REVISED HISTORIC TAX CREDIT

This article is adapted from updates provided by the National Park Service, National Conference of State Historic Preservation Officers, Novogradac & Company, National Trust Community Investment Corporation and the National Trust for Historic Preservation.

On December 22, Public Law No: 115-97 was signed and enacted, amending the Internal Revenue Code to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. The legislation, which goes into effect Jan. 1, 2018, preserves a revised historic tax credit. The bill eliminated the 10 percent tax credit for rehabilitation of buildings that were built before 1936 but are not listed in the National Register of Historic Places. The text of Public Law No. 115-97 is available here.

Senator Bill Cassidy (R-LA) drafted the amendment to retain the credit to 20 percent which was co-sponsored by Senators Chuck Grassley (R-IA), Pat Roberts (R-KS), Johnny Isakson (R-GA), and Tim Scott (R-SC). On the House side, Representatives David McKinley (R-WV), Rod Blum (R-IA), Bruce Westerman (R-AR), Mike Kelly (R-PA), Earl Blumenauer (D-OR), and Mike Turner (R-OH) provided critical support for the preservation of the historic tax credit.

Although the tax bill preserves the historic tax credit at 20 percent, it will require that the 20 percent credit be claimed “ratably over a five-year period beginning in the taxable year in which a qualified rehabilitated structure is placed in service.” This means that those who qualify for the tax credit would receive 4 percent per year for five years rather than 20 percent for one year.

The tax bill includes provisions for transitioning from the current historic tax credit to the version in the bill but the transition will be abrupt. As a result, SHPO review staff is anticipating a higher than normal volume of applications over the next several months. Prospective applicants are encouraged to ensure that their applications are complete and well-organized in order to insure a timely review.

Applicants requesting historic preservation certifications by the National Park Service as well as others interested in the use of these tax credits are strongly advised to consult an accountant, tax attorney, or other professional tax adviser, legal counsel, or the Internal Revenue Service regarding the changes to the Internal Revenue Code related to Public Law No: 115-97.

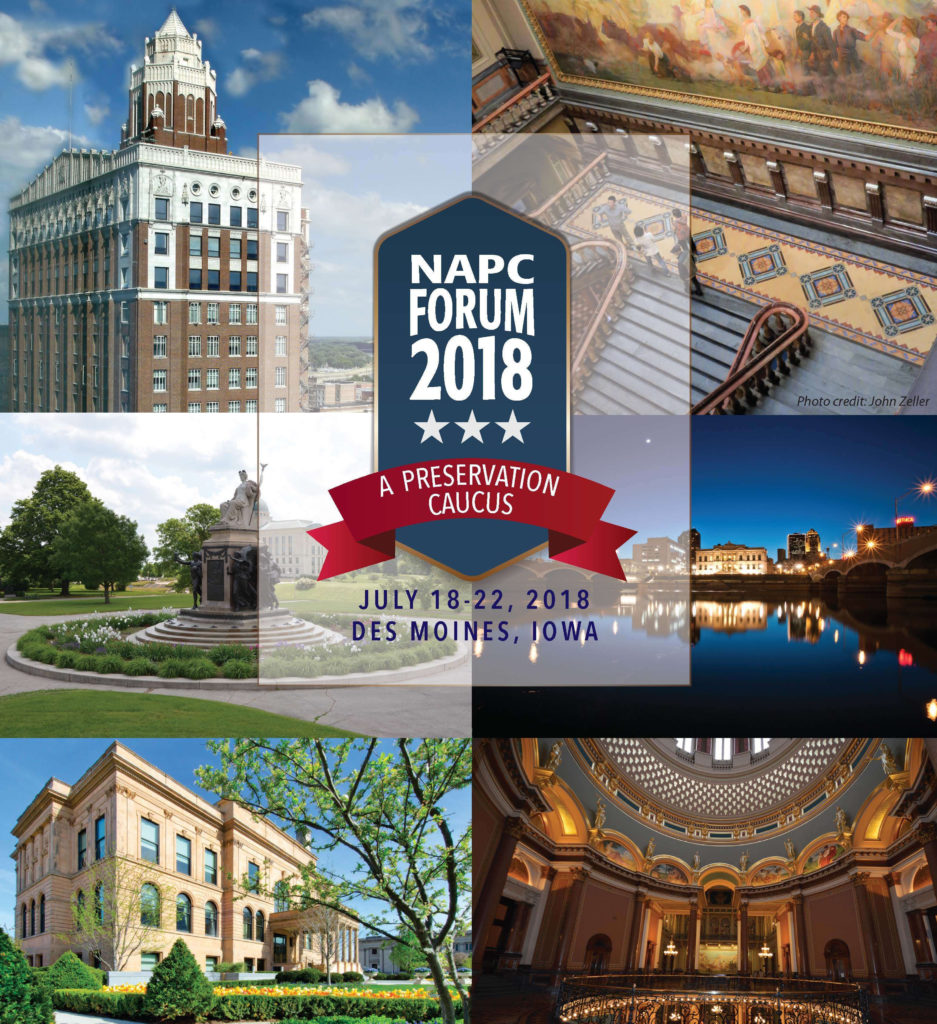

Attend a National Preservation Conference Without Leaving the State!

Join us in Des Moines for FORUM 2018!

The National Alliance of Preservation Commissions (NAPC) is bringing the biennial FORUM to Des Moines, from July 18 to 22, 2018. FORUM 2018 will feature dozens of educational sessions and discussion panels on topics ranging from the preservation of historic streetscapes, archaeology in historic districts, preservation zoning and advocacy. Mobile workshops and tours to some of central Iowa’s most exciting preservation projects are also planned. Attendees will have five days of non-stop networking for commission staff and volunteers representing local, state and national organizations and government agencies.

Previous FORUMs have been held in Philadelphia, New Orleans and San Antonio.

Members of Preservation Iowa and the National Alliance of Preservation Commissions will receive a special rate on their registration.

The Iowa State Historic Preservation Office and the City of Des Moines are lead partners for this conference. The Greater Des Moines Convention and Visitors Bureau is also a major supporter and partner of FORUM 2018.

For more info and updates go to the FORUM 2018 site or contact Paula Mohr at paula.mohr@iowa.gov

Tornado Spurs McGregor City Hall Facade Restoration

Contributed by Duane Boelman, Deputy City Clerk and Economic Development Director at the City of McGregor.

The McGregor City Hall was constructed in 1917 as a Christian Science Church. After the church closed in the 1970s, it served as a private residence, doctor’s office, and a Masonic Lodge before becoming the McGregor City Hall in the 1990s. In its centennial year, on the evening of July 19th, the building was heavily damaged when a category EF-1 tornado struck McGregor. In a few minutes, the entrance door, the fanlight over the entrance, a column, lamp posts, flagpole and the roof were all damaged.

LEFT: First Church of Christ, Scientist Church (now McGregor City Hall), c. 1917. CENTER: McGregor City Hall the morning of July 20, 2017. RIGHT: Restored McGregor City Hall on November 13, 2017

Shortly after the storm, city administration and McGregor’s Historic Preservation Commission made the decision that repairs, when possible, would be made in a historically sensitive manner. The fallen column and its base were removed for safe storage, historic photos of the building were located, and because of their experience in historic restoration, Wadsworth Construction of Decorah was contacted regarding the repair of the fanlight and replacing the damaged non-historic steel entrance door.

Because of a forward-looking individual, the original double multi-paned entrance doors had been stored in the building’s basement. Wadsworth Construction provided an estimate for restoration of the fanlight and reinstalling the historic double doors. With restoration costs close to that of modern replacements, the city’s insurance company approved the work.

With a historic photo as a guide, a local contractor rebuilt the roof. A volunteer repaired the decayed base of the toppled column, and another contractor carefully put both back in place. The lamp posts could not be saved, but replacements fitted with round shades appear much like the originals.

Wadsworth removed the fanlight and transported it along with the double doors to their workshop. There, the window glass was replaced where needed, and it was stripped, reglazed, primed and painted. The double doors were also cleaned, sanded, primed and painted. With some minor adjustments, weather stripping and a new lock, the century-old doors and fanlight are once again welcoming visitors to the building.